Early Financial Decision

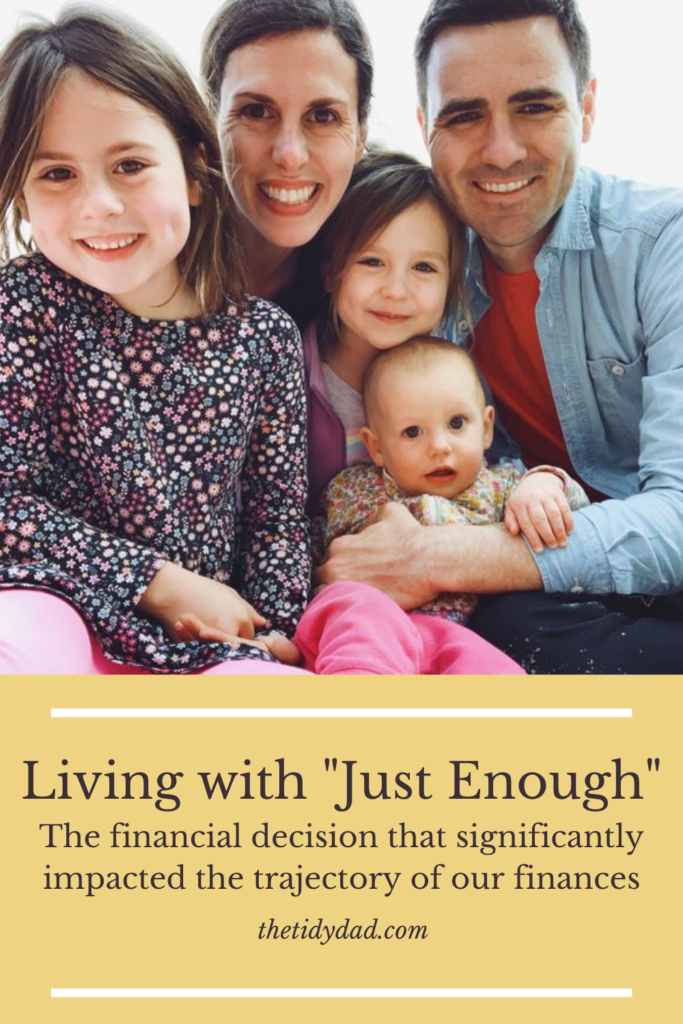

My wife, Emily, and I were high school sweethearts. We got married right after we graduated from college, during the summer we both turned 22 years old. We both graduated without student loan debt due to scholarships, money our parents and grandparents had saved, and working part-time jobs during college.

We moved into our very first apartment in Kentucky, and became 100% financially responsible for ourselves for the first time. I started my first teaching job with a salary of $30,000. Emily started a full-time Masters Program and took a part-time job at the university where she was in graduate school. At that point, we made a financial decision that significantly impacted the trajectory of our finances.

We decided to live on one income.

Live Below Your Means

We didn’t have lofty financial goals, but we never wanted to be in the place where we were stressed about finances. We intentionally chose to live below our means.

Finances can be very stressful. Financial stress can come from a variety of sources. Living to the max of your paycheck each month is one source of financial stress for many families. Regardless of income level, if you match your living expenses to your entire salary, you will always feel maxed out.

We’re not claiming our method of living on one income would work for every family, but simply sharing our own personal journey. I believe that we all have small ways we can tidy up our lives, and that can include finances.

What would it look like to live below your means, no matter your income level? What would it look like to live with a bit less? What would it look like to live with “just enough”?

Living on One Income – Graduate School

For us, living on one income meant that we would budget our rent, food, utilities, transportation, clothing, and any other expenses out of only my salary. Emily’s income went towards paying her tuition bills. She worked at the university between classes, and also babysat and taught piano lessons on the weekends. Somehow each semester, we were able to scrape together enough money for her to pay her tuition payments.

We had a tight budget. We chose a small one-bedroom apartment that we could afford. We watched friends move into larger apartments and nicer complexes with more amenities, but we stayed in our apartment for all 3 years that Emily was in graduate school.

We also made small sacrifices. We rarely ate at restaurants, went to movies, or went shopping. We didn’t buy fancy phones or technology. We drove the cars we got in high school. Emily developed some extreme couponing skills which helped to keep our grocery bill low.

After Emily completed her Masters degree, we moved to New York City and it was my turn to get my Masters degree. Emily worked full-time as a pediatric occupational therapist, and we chose an apartment we could afford on only her salary. I worked full-time as a teacher, but all of my income went towards paying my graduate school tuition. 5 years into our marriage, we had both earned our Masters degrees without taking out any student loans.

Living on One Income – Pre-Kids

After I finished graduate school, we had a few years where we were both working full-time before we had children. Our early financial decision set a pattern for us in terms of how we spend our money. Even though we were finished paying tuition bills, we continued to live in our one-bedroom apartment and save our second income. We were able to set aside money for our savings account, investments, retirement, and vacations, including a trip to Australia for our 5-year anniversary.

Living on One Income – With Kids

When our first daughter (Mabel) was born, we finally upgraded to a 2-bedroom apartment in a rent-stabilized building. Emily was able to decrease her work to part-time without any strain on our living expenses. Her part-time income was helpful for us to reach some financial goals, but we weren’t dependent on it for our daily living.

When Mabel was a baby, I did take a promotion at work that came with a salary increase. I soon realized the job wasn’t the right fit for me. After the birth of our second daughter (Matilda), I returned to classroom teaching. It felt daunting to “step back”, but Emily and I reminded ourselves that we were living with “just enough”. We had an apartment that was perfect for our family. We had a car that we were able to drive and was working for us. The additional stress and anxiety that came from the promotion wasn’t worth the cost to my mental health.

Living on One Income – Present Day

In 2019, I started thetidydad.com website and instagram account. We found out we were expecting our third daughter (Margaret). We also used part of our savings account as a down payment for our Woodland Cottage in Pennsylvania. Emily stopped working as a part-time occupational therapist so that she could provide full-time childcare to our three daughters. She also manages the business side of Tidy Dad and manages our cottage as a short-term rental property. We continue to only spend my teaching salary on living expenses, including our cottage mortgage.

Living with “Just Enough”

When it comes to finances, Emily and I have intentionally chosen to live with “just enough.” I love my work as a teacher, and my salary provides “just enough” for our family.

I’m sharing our personal journey, because I believe we all have small ways we can tidy up our finances. Whether you are married or single, whether you are a student or a worker, and whether your family has one income or two, I encourage you to consider your finances.

Instead of living on 100%, what would it look like for you to live on 90%? Or 75%? Or 50%?

What would it look like to live below your means, no matter your income level? What would it look like to live with a bit less? What would it look like to live with “just enough”.

Hi, I'm Tyler!

I'm a NYC teacher, writer, and dad of 3 girls. My wife and I live with our daughters in a

750-square-foot apartment in New York City. I'm on a journey to tidy up my life. I share practical, routine-driven approaches to tidying, because I believe the process of tidying can make space for what matters.

May 24, 2021

“Just Enough” with Finances

free download

grab the checklist

Browse All

parenting & Daily Living

Browse All

Tidying & Organizing

Browse All

Meal Planning & Cooking

More about tidy dad

transform your cleaning routine!

Browse All

recipes

daily cleaning checklist

Click here to subscribe

Subscribe!

Stay informed with

the latest from tidy dad

5 tips for tidying

with kids

free download

grab the resource

Browse All

NYC Adventures

Early Financial Decision

My wife, Emily, and I were high school sweethearts. We got married right after we graduated from college, during the summer we both turned 22 years old. We both graduated without student loan debt due to scholarships, money our parents and grandparents had saved, and working part-time jobs during college.

We moved into our very first apartment in Kentucky, and became 100% financially responsible for ourselves for the first time. I started my first teaching job with a salary of $30,000. Emily started a full-time Masters Program and took a part-time job at the university where she was in graduate school. At that point, we made a financial decision that significantly impacted the trajectory of our finances.

We decided to live on one income.

Live Below Your Means

We didn’t have lofty financial goals, but we never wanted to be in the place where we were stressed about finances. We intentionally chose to live below our means.

Finances can be very stressful. Financial stress can come from a variety of sources. Living to the max of your paycheck each month is one source of financial stress for many families. Regardless of income level, if you match your living expenses to your entire salary, you will always feel maxed out.

We’re not claiming our method of living on one income would work for every family, but simply sharing our own personal journey. I believe that we all have small ways we can tidy up our lives, and that can include finances.

What would it look like to live below your means, no matter your income level? What would it look like to live with a bit less? What would it look like to live with “just enough”?

Living on One Income – Graduate School

For us, living on one income meant that we would budget our rent, food, utilities, transportation, clothing, and any other expenses out of only my salary. Emily’s income went towards paying her tuition bills. She worked at the university between classes, and also babysat and taught piano lessons on the weekends. Somehow each semester, we were able to scrape together enough money for her to pay her tuition payments.

We had a tight budget. We chose a small one-bedroom apartment that we could afford. We watched friends move into larger apartments and nicer complexes with more amenities, but we stayed in our apartment for all 3 years that Emily was in graduate school.

We also made small sacrifices. We rarely ate at restaurants, went to movies, or went shopping. We didn’t buy fancy phones or technology. We drove the cars we got in high school. Emily developed some extreme couponing skills which helped to keep our grocery bill low.

After Emily completed her Masters degree, we moved to New York City and it was my turn to get my Masters degree. Emily worked full-time as a pediatric occupational therapist, and we chose an apartment we could afford on only her salary. I worked full-time as a teacher, but all of my income went towards paying my graduate school tuition. 5 years into our marriage, we had both earned our Masters degrees without taking out any student loans.

Living on One Income – Pre-Kids

After I finished graduate school, we had a few years where we were both working full-time before we had children. Our early financial decision set a pattern for us in terms of how we spend our money. Even though we were finished paying tuition bills, we continued to live in our one-bedroom apartment and save our second income. We were able to set aside money for our savings account, investments, retirement, and vacations, including a trip to Australia for our 5-year anniversary.

Living on One Income – With Kids

When our first daughter (Mabel) was born, we finally upgraded to a 2-bedroom apartment in a rent-stabilized building. Emily was able to decrease her work to part-time without any strain on our living expenses. Her part-time income was helpful for us to reach some financial goals, but we weren’t dependent on it for our daily living.

When Mabel was a baby, I did take a promotion at work that came with a salary increase. I soon realized the job wasn’t the right fit for me. After the birth of our second daughter (Matilda), I returned to classroom teaching. It felt daunting to “step back”, but Emily and I reminded ourselves that we were living with “just enough”. We had an apartment that was perfect for our family. We had a car that we were able to drive and was working for us. The additional stress and anxiety that came from the promotion wasn’t worth the cost to my mental health.

Living on One Income – Present Day

In 2019, I started thetidydad.com website and instagram account. We found out we were expecting our third daughter (Margaret). We also used part of our savings account as a down payment for our Woodland Cottage in Pennsylvania. Emily stopped working as a part-time occupational therapist so that she could provide full-time childcare to our three daughters. She also manages the business side of Tidy Dad and manages our cottage as a short-term rental property. We continue to only spend my teaching salary on living expenses, including our cottage mortgage.

Living with “Just Enough”

When it comes to finances, Emily and I have intentionally chosen to live with “just enough.” I love my work as a teacher, and my salary provides “just enough” for our family.

I’m sharing our personal journey, because I believe we all have small ways we can tidy up our finances. Whether you are married or single, whether you are a student or a worker, and whether your family has one income or two, I encourage you to consider your finances.

Instead of living on 100%, what would it look like for you to live on 90%? Or 75%? Or 50%?

What would it look like to live below your means, no matter your income level? What would it look like to live with a bit less? What would it look like to live with “just enough”.

May 24, 2021

“Just Enough” with Finances

About me

Hi, my name is Tyler Moore. My wife and I live with our three young daughters in a 700- square-foot apartment in New York City. I began my tidying journey when an early-30’s crisis invited me to reflect upon, challenge, and change my patterns of daily living. I quit my job as a school administrator, returned to teaching, and started Tidy Dad to help others tidy, simplify, and find joy in their lives. I firmly believe the tidying process can transform your life. I’d love for you to join me in exploring ways that tidying can make room for what’s important in life.